IFRS 9 Impairment Solution Pro (ISP)

IFRS 9 Impairment Solution Pro (ISP) is an innovative solution designed to facilitate financial institutions in accurate computation of expected credit losses in accordance with the requirements of IFRS 9 and statutory guidelines. ISP empowers financial institutions in assessing future losses based on forward-looking macro-economic factors. It is primarily tailored for use by financial institutions, such as commercial banks, microfinance banks, fintechs, leasing companies and non-banking finance companies.

IFRS 9 Consultancy Services

Under IFRS 9 consultancy services we provide following:

- IFRS 9 ECL Engine (tool)

- IFRS 9 implementation and impact assessment

- Review of existing IFRS 9 policies and models

- IFRS 9 training and support

IFRS 9 ECL Engine

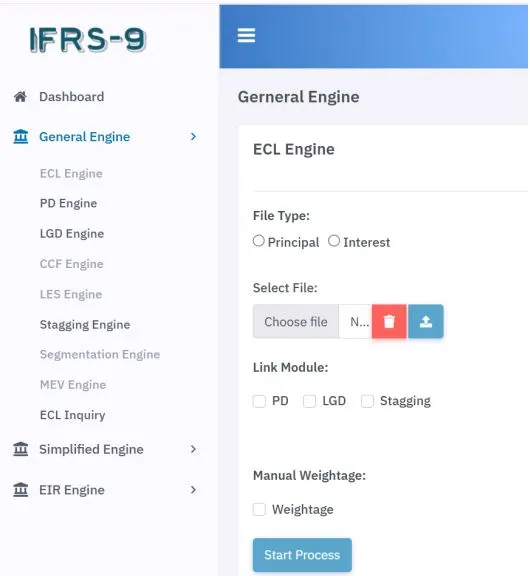

We, in partnership with a software company, have developed in-house IFRS 9 impairment calculation software. ISP has following Core modules (engines)

- Expected credit loss (ECL) Engine

- Probability of default (PD) Engine

- Loss give default (LGD) Engine

- Effective Interest rate (EIR) Engine

- Staging engine

IFRS 9 implementation and impact assessment

- We provide assistance in assessment of classification and measurement of financial instruments and we provide models for SPPI test and business model tests

- We provide assistance in preparation of following models

- EIR model

- Probability of default- rating based

- Probability of default- DPD based

- Loss given default

- Credit conversion factor

- Estimation of life for revolving product

- Expected credit loss engine

- We assist in preparation of financial statements disclosures as per requirement of IFRS 7 and IFRS 9

- We prepare policies and accounting manuals related to IFRS 9

- We assist in framing the governance structure and internal controls related to IFRS 9

Review of existing IFRS 9 polices and models

We provide services related to review of current IFRS 9 polices and model. Our services include:

- Assess and review overall ECL estimation approach and methodologies

- Review governance and controls over ECL engine

- Analyze the appropriateness of the factors such as:

- Amortization and life-time estimation

- Segmentation

- Default definition

- SICR criteria

- PD models and methodology

- LGD models and methodology

- CCF models and methodology

- Behavioral life of revolving loans (or non-contractual loans)

- Allocation of effective interest rates

- Macro-economic selection and scenarios

- We assist in preparation of financial statements disclosures as per requirement of IFRS 7 and IFRS 9

- We prepare policies and accounting manuals related to IFRS 9

- We assist in framing the governance structure and internal controls related to IFRS 9

IFRS 9 training and support

We provide customized training programs and workshops to educate finance teams, internal auditors, and other stakeholders on the principles and requirements of IFRS 9, including practical examples, case studies, and implementation best practices. Following are example of IFRS 9 related trainings:

Introduction to IFRS 9

A comprehensive overview of the key principles, objectives, and scope of IFRS 9, including explanations of the classification and measurement of financial instruments, impairment requirements, and hedge accounting.

IFRS 9 Technical Workshops:

In-depth sessions focusing on specific technical aspects of IFRS 9, such as the classification and measurement of financial assets and liabilities, impairment modeling techniques, and hedge accounting strategies.

IFRS 9 Updates and Regulatory Developments:

Seminars and webinars providing updates on recent developments related to IFRS 9, including amendments, interpretations, and regulatory changes, and their potential impact on financial reporting practices.

IFRS 9 Refresher Courses:

Short, targeted sessions aimed at refreshing participants' knowledge of specific aspects of IFRS 9, such as impairment accounting or hedge accounting, and addressing common challenges and misconceptions.

We provide comprehensive training materials, including workbooks, manuals, and reference guides, to supplement training sessions and serve as ongoing resources for participants to reinforce their learning.

Why Financial Institutions Choose Us?

Banking Specialization

Deep expertise in retail, corporate and Islamic banking requirements

Big 4 Heritage

Methodologies developed by former Deloitte and EY professionals

Technology Integration

Seamless implementation with your existing systems

Why Choose Our IFRS 9 ECL Calculator?

We, in partnership with a software company, have developed in-house IFRS 9 impairment calculation software. ISP has following Core modules (engines)

- Advanced Expected Credit Loss modeling as per IFRS 9 standards

- Automated ECL calculations with real-time reporting

- IFRS 9 provisioning tool for banks and financial institutions

- Fully cloud-based solution – no installation required

- Free downloadable ECL calculation Excel template

- Custom models for trade receivables, loans, and SME portfolios

- Back-testing and disclosure reports for auditors

Why Our Clients Trust Us

With decades of experience in financial reporting and credit risk management, we are one of the top IFRS 9 implementation firms in Pakistan. We offer not just tools, but complete IFRS 9 advisory services, training, and consultancy. Our intuitive ECL calculator integrates with your accounting software to deliver accurate, audit-ready results.

Why Financial Institutions Choose Us?

- Stage 1, 2, 3 impairment modeling

- Macro-economic overlays

- Lifetime & 12-month ECL support

- Downloadable reports and disclosure statements

- Back-testing & benchmarking tools

- Integration with Excel and ERP systems

- Machine learning models for ECL forecasts

- Affordable pricing for SMEs and startups

Request a Demo

Contact us today to explore the best ECL calculator for IFRS 9 compliance. Whether you're a bank, SME, or consultant, we have a solution for you.

Call: +92 51 2120733 | +92 51 8442121 | +92 321 5171516 | +92 303 0153740 Email: info@proconsulti.com

Book a Demo IFRS 9 Solution Brochure IFRS 9: Pre-Implementation Impact Study on Pakistani Banks